We are pleased to announce that Cogent QC Systems has won the 2019 HousingWire Tech100 award, marking the fourth time that Cogent has been chosen for this select group of technology providers. More information about the HousingWire Tech100 is available here.

Among the factors that led to the win, the judges cited Cogent QC Systems‘ new cloud solution, the versatility to audit almost any type of mortgage or consumer loan in a single system, and the ability to introduce custom functionality upon request.

A big thank you to the HousingWire judges. We are honored and inspired!

The Cogent Team

Cogent QC Systems Are Now Available in the Cloud!

Introducing Cogent QC Essentials. A web-based quality, compliance and risk management solution that gives you access to Cogent’s award-winning QC technology directly through your browser.

Nothing to install in-house and nothing to maintain in-house means you can get up and running in short order. And it means less reliance on your IT department, which is usually busy enough on other projects.

Contact us for more details. We’d love to tell you more about it and show you a demo.

Mortgage Technology – A Whole New World

Mortgage technologists gathered this week at the MBA Tech18 conference to talk about the digital mortgage, mobile applications, artificial intelligence, APIs, block chain, and even drones, robots, augmented reality and the Internet of Things. Heady stuff, and a far cry from pre-crisis days. This is not your father’s mortgage technology, and as the pace picks up, there will be a shake-out of traditional players who don’t adapt.

The theme of disruption was illustrated nicely in the two keynotes. By some miracle, Oakland A’s General Manager Billie Beane made statistics interesting and humorous, showing how he teamed with a baseball outsider to ultimately revolutionize baseball. Quicken Loans’ Dan Gilbert and Bill Emerson were equally entertaining in their keynote, as they bantered about how Rocket Mortgage came to disrupt the mortgage landscape. Speaker presentations are available to MBA members here.

With loan origination costs now up to $8,500 per loan, cost reduction through process automation has everyone’s attention. The cool technology is coming but until then, most organizations can pick the low-hanging fruit by automating manual processes, according to several speakers. Paper-based processes, error-prone data entry into silo-ed systems (requiring redundant re-entry), triple checking of work, and many things involving Excel can be streamlined without new technology. We have some ideas about this in our earlier post, in case you haven’t explored them yet. Look for more posts soon covering some interesting ways to think about using technology effectively in your organization.

Calculate, Streamline and Automate

Technology is rapidly transforming mortgage banking. If you went to the MBA Tech18 conference, you saw some of the companies leading the charge. But with enterprise software, change can be slow to arrive. What can you do right now to boost productivity, streamline processes and automate workflows?

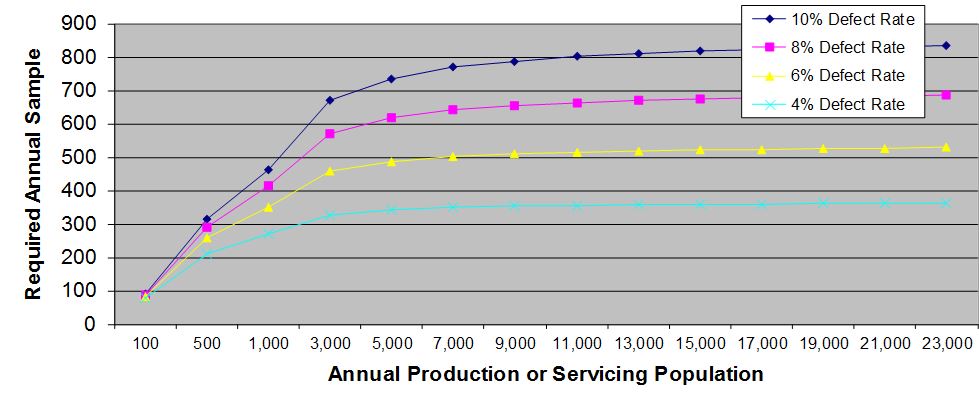

How about optimizing your sampling? Try our statistical sample size calculator and some of our white papers on leveraging statistics. You might get more done with less work. If you’d like to discuss how, contact us.

And while we automate client processes by leveraging Cogent QC Systems tech tools, you may find that revisiting the manual steps in your workflow will be fruitful, especially if that workflow has not changed in years.

Ultimately, when you’re ready for an adaptable workflow technology for your quality, compliance and risk management, let us know. We’d love to show you the most feature-rich, most customizable system available.

Statistical Sample Size Calculator

Our standard statistical sample size calculator is now available as a free resource online. If you haven’t seen it yet, we encourage you to try it.

If you need help, check out the guides and white papers on our Resources page.

And if you have any feedback about how to improve the calculator, let us know. We’re planning an upgrade and we need your input.

Thanks for visiting!

The Cogent Team