Cogent QC Systems have been used to guide the QC reviews of trillions of dollars in mortgage originations and millions of servicing records. Our clients are lenders of all sizes, including some of the top banks and mortgage companies in the nation. They use the system for all kinds of audits, including mortgage, auto, credit card, indirect, unsecured loans and more.

The following client case studies are real. Names have been changed to protect confidentiality.

System Deployments Transform QC Operations

Case Study #1: Midwestern Bank Transforms Mortgage QC Productivity

Case Study #2: Western Mortgage Corporation Radically Improves Mortgage QC Efficiency & Timeliness

Case Study #3: Able Mortgage Insurance Streamlines MI Underwriting Audits with Bespoke System Features

Case Study #4: Able Mortgage Insurance II Adapts Cogent QC System to Efficiently Manage New Product Audits

Case Study #5: National Diversified Modifies Auto Loan QC Workflows to Automate Audits & Reduce Human Error

Custom Tools Boost Productivity

Custom Tool 1: Customized Repurchase, MI, & Claims Tracking Tool Pays For Itself Immediately

Custom Tool 2: Custom Reporting to Multi-Tab Excel Workbooks Saves 25 Person-Hours Per Month

Custom Tool 3: Custom Audit Workflow Reduces Work by 50%

Custom Tool 4: Customization Automates Lender Correspondence by Lender, Product & Underwriting Type

Case Study #1: Midwestern Bank Transforms Mortgage QC Productivity

Midwestern Bank is one of the largest loan originators in the country. They cope with massive volume on a daily basis, and have incorporated several new acquisitions. They use Cogent QC Systems to address their volume without strain and save hundreds of thousands of dollars in audit review costs.

“We needed an automated process that would take some of the burden off the quality control department, and a system that would provide clear, reliable insights into our origination quality,” said Midwestern’s QC Manager. “And given the size and complexity of our operations, we weren’t just looking for a system vendor, but a partner in designing and implementing a modernized, upgraded methodology.”

Highlighters Run Out of Ink

When she took over as QC Manager, Midwestern Bank’s quality control procedures were largely manual and paper-based. “Even though we had already received a reprieve from Fannie Mae and Freddie Mac from reviewing 10% of our loan volume,” she said, “we were still required to review 5% of a monthly loan volume of 15,000 loans per month. This meant reviewing 750 loans per month. And we knew this number would grow.”

At the time, the process involved printing a three-inch stack of loan records, having an analyst highlight every twentieth record, and sending the stack to a file repository center to retrieve the files for audits. File auditing was driven primarily by checklists, and management reports consisted of additional stacks of paper that simply listed loans with any kind of exception. The process was inefficient and labor-intensive, and the resulting information was opaque. With an anticipated doubling of volume on the horizon, the highlighter would run out of ink. Clearly, something had to change.

In a previous role, the QC Manager had been involved in the implementation of several automated underwriting systems. Based on her experience with implementing software, she understood that a software system was only as good as the company behind it. She also understood that purchasing the software was only the first aspect of an implementation.

“Software bells and whistles are fine,” she says, “but if you can’t get the system implemented properly, or if it can’t adapt to your processes, or maintenance is a nightmare, you may as well not have the system at all. It’s going to cause more aggravation – and a lot more money – than it’s worth.”

After researching the market, she spent weeks calling users of each major loan quality control system on the market and asked them about their experiences with their software and vendors. After compiling and reviewing her data, she made a presentation to her colleagues advocating the implementation of the Cogent ProductionQC system for origination and compliance reviews, based on both the versatility it offered and the extensive customer support that came with the software.

Her counterpart on the compliance side was the Compliance Audit Supervisor, and she was of the same mind. “It was important to us that we tightly coordinate our processes,” she said, “and using the same platform clearly presented advantages. Cogent was the only vendor that offered a complete QC solution for the entire mortgage origination process, including production, compliance and servicing.” The decision was made to implement the Cogent ProductionQC system.

Can You Do It In 60 Days?

In selecting Cogent, Midwestern Bank recruited a partner with three important knowledge bases: wide experience in the mortgage industry, solid understanding of quality control processes, and deep skills in software design and architecture. All three would be critical to customizing and evolving a system to suit Midwestern Bank’s needs. And Cogent’s partnering style of system development was well suited to Midwestern Bank’s needs.

The Midwestern Bank QC staff had to settle important questions about what functions they wanted their system to perform, and the Cogent development team had to quickly and accurately explain when and how they could deliver. New practices, policies and procedures would have to be introduced. New workflow, new methods and new terminologies needed to be integrated into the process. And staff would have to be trained on a new system. Further, this transition had to occur smoothly, without disrupting the normal operations of the business. And it all had to happen within 60 days, before the IT department’s end-of-year system freeze took place.

Cogent’s development team was up to the task. Together with the QC management at Midwestern Bank, they hammered out a coherent picture of what the system ought to look like, and began to turn that vision into a reality. Midwestern Bank and Cogent completed the implementation in the allotted time, and got the system up and running with minimal problems.

Building on Success

After implementation of the Cogent ProductionQC system, Midwestern Bank’s production QC department still reviews approximately 750 loans every month. The difference, however, is that their loan volume has doubled. These 750 loans no longer comprise a 5% sample, but rather a 2.5% sample. Meanwhile, the compliance department successfully achieves better and more reliable results with a 1% sample than it previously did with a 5% sample.

Since that time, Midwestern Bank has also implemented the Cogent ServicingQC system. In the future, as the company continues its expansion, Cogent will continue to be there to assist in streamlining their QC processes throughout the enterprise.

Western Mortgage Corporation Radically Improves Mortgage QC Efficiency & Timeliness

Western Mortgage Corporation is one of the nation’s largest privately held multi-channel mortgage companies . Their story demonstrates how Cogent can help to dramatically improve the efficiency of a QC department and enable QC managers to produce meaningful results for branch managers and senior executives in a timely fashion.

At the turn of the millennium, Western experienced a substantial increase in its origination volumes, with dramatic implications for its quality control department.

The QC Manager at Western took time from her schedule to explain the course of developments in her organization that led to the deployment of the Cogent ProductionQC System.

“We don’t like to talk about the past too much. We call it BC – Before Cogent.”

When Western’s Risk Management department created a Quality Control unit, production levels were low enough that the department’s staff members could audit 10% of their monthly production volume, examining 70 to 100 loans a month.

Within three years, production volume had increased to over 10,000 units a month, and auditors were attempting to manually process more than ten times their previous workload. The 6 in-house auditors worked 8 hour shifts at the office and then took files home to complete audits.

Despite the availability of a support staff, timely reverification proved impossible. Some months were never completely reviewed because the production volume simply exceeded QC’s capacity to audit. The result was sporadic reporting that consisted primarily of massive amounts of unorganized data.

The company considered dissolving the QC department and outsourcing its functions, but discovered that they would be unable to achieve the results they wanted without spending an exorbitant amount of money per file reviewed. And even in this instance, they needed to retain personnel to process the review data, create the proper reports, and to interface with the outsourcing firm.

As a result, senior management encouraged research into a software system. The QC Manager performed the necessary work to demonstrate that Western met the agency criteria to allow statistical sampling, and began shopping for a system that would help to turn the situation around. Her manager, the VP of Risk Management, was enthusiastic about the idea, as was Western’s senior management, who were eager to see QC be more efficient and effective. After careful consideration, Western decided to implement the Cogent ProductionQC System.

“It’s hard to compare apples to apples, because things are so different now.”

Before Cogent, the company was auditing on average 800 loans per month. Audits began 60 days after the end of the production month, and reports were released months later.

After implementing Cogent, production levels were approximately the same as the previous year, but the company had to audit only 124 loans for June, 174 for July, and 145 for August. Audits began 7 days after the end of the production month, were finished within 30 days, and reports were furnished to investors and agencies within 60 days.

These audits included more than just statistical samples. They also encompassed targeted reviews, designed to isolate potential problem areas and produce results in the short term. As the QC Manager explains, “One of our challenges is building credibility with the various branches, and so targeted reviews enable us to provide them with timely feedback that saves them money. One of our auditors found a loan for a property that did not exist, and we checked the pipeline to find 8 more loan applications from the same loan officer and appraiser. We performed a targeted review, and discovered that this appraiser was often overvaluing single family homes by as much as $200,000. We forwarded the information to our Fraud and Legal departments, as well as the branch, and they were able to prevent further losses. Every month, I receive e-mails thanking us for the work we’ve done on behalf of the branches.”

The QC department’s accomplishments are even more impressive considering that their staff size has been reduced dramatically. The old QC department had 14 staff members with 6 active auditors. After implementing Cogent, QC accomplished its goals with 8 people, and only 4 auditors, one of whom worked part time!

“Every day we get a little closer to being the type of department we’re striving to be.”

Developing credibility with production units can be challenging. The QC Manager believed that she and her team were up to the task. “One of the positive features of the Cogent system is that it is user friendly and easy to learn, and so I am working on promoting one of my auditors to a senior position so that I can shift my responsibilities more towards interfacing with other departments. In addition, I have a member of our support staff training to become an auditor.”

The QC department’s goal is to build its credibility, develop its relationships with other departments, and eventually reach the point where it can efficiently perform pre-funding reviews and catch problems before they impact the company’s bottom line. Using the Cogent system’s Feedback functions is just one of the ways that the department plans to pursue this goal.

In a very short amount of time, Western managed to turn its QC outlook around 180 degrees. Sound management, coupled with a sense of initiative and a desire to excel produced this change. Cogent’s top-notch technology and support were there to help realize it.

Case Study #3: Able Mortgage Insurance Streamlines MI Underwriting Audits with Bespoke System Features

A few years ago, Able Mortgage Insurance (AMI) settled on the Cogent ProductionQC System to manage their MI underwriting QC audits. At the time, their needs were basic – efficient sampling, streamlined auditing, and effective, actionable reporting – and quarterly statistically valid QC audits covering two lines of business (non-delegated underwriting and delegated underwriting with validation). In short order, these needs were met by the initial deployment of Cogent.

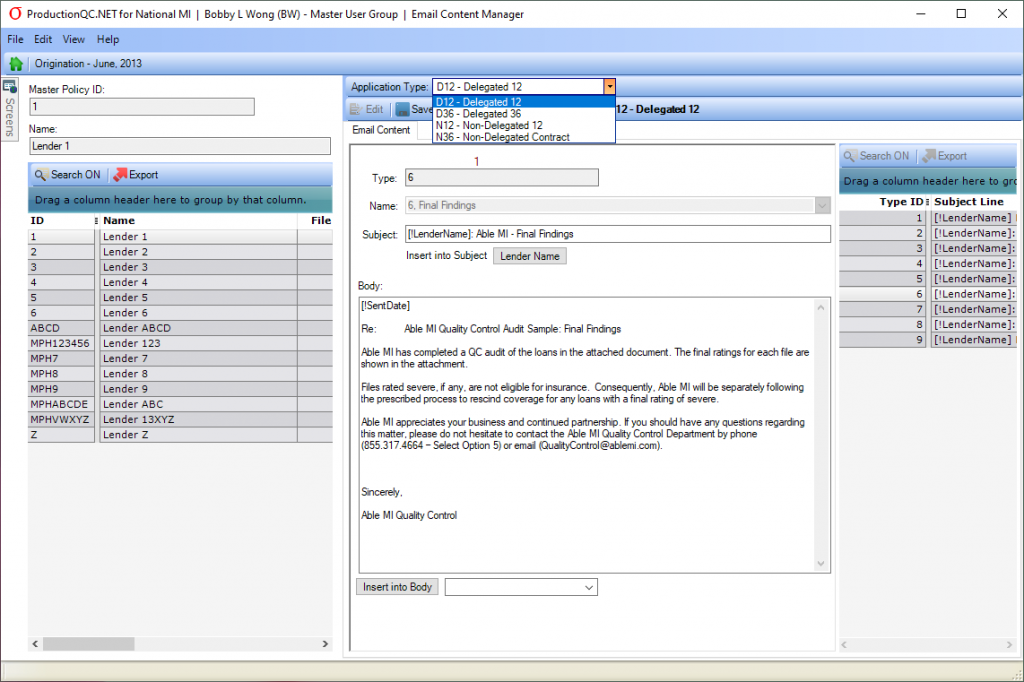

AMI later decided to introduce delegated without validation, introducing the need for a 3rd statistically valid QC audit, and one that required that the QC department work directly with lenders to request files and share audit results. The tracking, management and exchange of documents required automation beyond the standard workflows of the Cogent system. At AMI’s request, Cogent’s Professional Services group developed a Lender Correspondence workflow solution to branch off the existing Cogent sampling and document ordering process, streamlining the entire process. Included in the solution were the following:

1. Product-specific and/or lender-specific email template editing and generation screens for File Request, Past Due Notice, Preliminary [QC] Findings, Final Findings, and 12-month Summary.

2. Screen to Process Receipt of documents requested.

3. Tracking of documents requested and received, and updating of first, second and final reminder request lists for attachment to outgoing emails.

4. Post-review reporting, singly or in batch, on errors, cures, and policy rescissions, as well as 12-month summary and trend reports indicating lender performance vis-à- vis AMI program

benchmarks.

5. Product-specific Tracking Configuration screens, enabling user-specified time frames for various actions, including monthly/quarterly file request due dates, second file request due dates, preliminary findings feedback and more.

This new functionality was delivered and deployed in multiple phases, and has automated much of AMI QC’s lender correspondence process.

But the changes keep coming. The latest phase involves a QC audit of the closing of loans approved by AMI via its non-delegated business line. The functionality that Cogent delivered to manage the 3 rd audit (described above) is being leveraged to provide similar efficiencies for this new endeavor.

Going forward, AMI may ask Cogent to automate parts of this process that were deliberately left out of scope. For example, the actual receipt and storing of incoming documents was kept deliberately manual, as was the updating of database tables reflecting document receipt; the updating of lender contact emails, as well as CC and BCC fields, is manual; and so is any updating of lender names. Although AMI does not wish to automate these processes today, things may change tomorrow. It wouldn’t be the first time.

Case Study #4: Able Mortgage Insurance II Adapts Cogent QC System to Efficiently Manage New Product Audits

A short eighteen months after its initial case study, Able Mortgage Insurance (AMI) announced an auditing milestone: 10,000 loans audited since the inception of the quality control group and the deployment of the Cogent ProductionQC system.

With a combination of smart sampling and automation of much of its lender correspondence process, AMI’s QC team had dramatically increased their efficiency and effectiveness:

- Auditing capacity doubled to 3,000 audits per year (up from 1500 audits in Year 1)

- The scope of the audits evolved over time to include reverifications, field reviews and other enhancements

- QC now publishes 20 quarterly origination quality assessment reports each year (up from 8 originally)

This is impressive enough in a static mortgage environment, but AMI was simultaneously dealing with a steady stream of changing requirements from Fannie Mae and Freddie Mac. New rules around reverifications, early rescission and more meant expanded audits and modifications to sampling strategy. These had to be taken in stride as the QC team tried to stay on top of AMI’s growing auditing needs.

“Our goal at the beginning was to ensure we were monitoring the quality of loans from each channel by which loans entered the portfolio according to the standards we felt were most appropriate,” said the QC Manager, Ted Turner. “Once we got our systems and processes in line, we could turn our attention to scaling and streamlining the operation. At the same time, we had to be responsive to new and changing requirements specified by Fannie and Freddie in their Private Mortgage Insurer Eligibility Requirements. And of course, we had to contain costs.”

While initially AMI had deployed Cogent technology to automate its processes, for this next phase they not only further leveraged that automation to support new audits, but also leveraged Cogent’s statistical sampling methodology to gain efficiencies. By following Cogent’s sampling strategies and letting the system calculate and optimize statistical sample sizes where practical, AMI has increased the volume of its existing audit reviews, added new audits, and gained better insight into quality – all while minimizing the number of required audits and thereby headcount.

“The “Amended and Restated GSE Rescission Relief Principles” published in September 2018 includes a “Closing Document Exception for Non-Delegated Underwritten Loans,” said Turner. “This makes available to an MI company’s customers a new rescission relief option, provided the MI carries out a new QC audit to the specified standards. Using Cogent, AMI was able to quickly add the new audit (and related lender correspondence) to its processes while keeping the staffing impact and incremental file audits to a minimum.”

Next year the department will also begin to assess certain servicing and claims activities, and will publish supplemental QC reports covering other key Insurance Operations activities (lender approval, lender monitoring, and program variance approvals).

As the QC team ramps up even further, the challenge will be to balance hiring of new audit staff with auditing efficiency.

Although AMI does not wish to automate these processes today, things may change tomorrow. It wouldn’t be the first time.

Case Study #5: National Diversified Modifies Auto Loan QC Workflows to Automate Audits & Reduce Human Error

After using the Cogent system for a number of years, National Diversified had developed a highly sophisticated statistical sampling approach that was efficiently monitoring all significant risk areas. This approach fully leveraged the Cogent system’s standard statistical targeting features and measurably lifted productivity.

But as they got a handle on their loan risks and errors, they also got insight into their auditors’ human errors. There were clear opportunities for improvement. With a large number of auditors, however, re-training was not the ideal solution. It made more sense to simplify the audit process. So they approached Cogent about customizing their audit modules.

Ultimately, the audit workflow was transformed, eliminating human error at several points in the process. “It was a huge win for us, in multiple ways,” says the group’s lead ‘optimizer’. “Just eliminating one click from the auditors’ process saves us 21,000 clicks over a standard audit cycle.” In partnership with Cogent, management requested several customizations over time, expanding and building on each other.

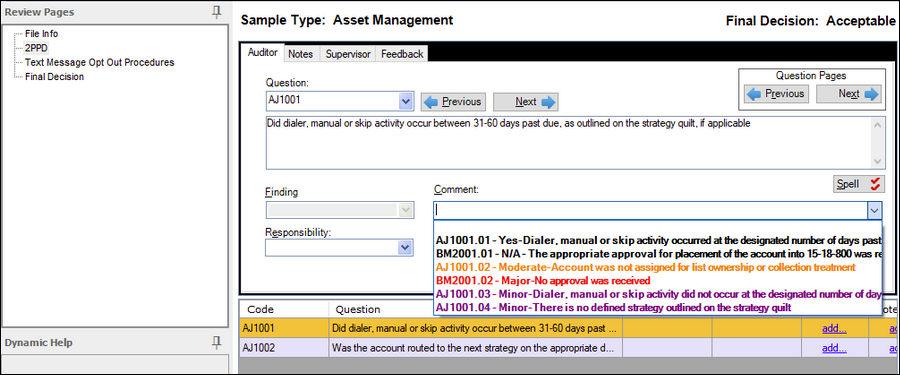

Preset Comments Take the Lead – Instead of having auditors select a Finding from a drop-down list and supplement their Finding with a free-form comment, National Diversified decided to leverage Cogent’s Preset Comment feature to simplify the audit. The system was customized so that the Preset Comment color-code drove the Finding, which was de-activated. This meant fewer clicks, less free-form input, and no ambiguity in Findings selection. This, plus simple color-coding led to reduced human error and faster audits.

The Decision is Out of the Auditor’s Hands – Traditionally, auditors in Cogent make a Final Decision on a loan based on the Findings they have observed in the audit. This can introduce ambiguity, which can lead to human error. National Diversified wanted to automate the Final Decision and take the cognitive load off the auditors. This required establishing rules for the decision-making, which required clarification of what constituted an error or defect, and how severe it was considered to be. When the rules were implemented, this particular risk of human error was eliminated. And audits went faster.

Reporting is the End Game – With their unique product line and diversity of products, National Diversified’s report generation process involved exporting data from Cogent, implementing 300-400 spreadsheet pivots and manually creating reports, which took 1.5 person-days per month. And still there would be errors. They wanted to eliminate the manual calculation of counts and generate reports directly from the system, based on error levels. After introducing Cogent’s reporting customizations, reporting became incomparably more reliable, more flexible and quicker to generate.

The system enhancement requests continue: new functionality to automate loan assignments to auditors, configurable feedback rules based on audit process, addition of new groups and users to the Cogent platform, and more. Why stop now? Says the group’s lead optimizer, “If you can give me a Yes or No answer, I can automate.”

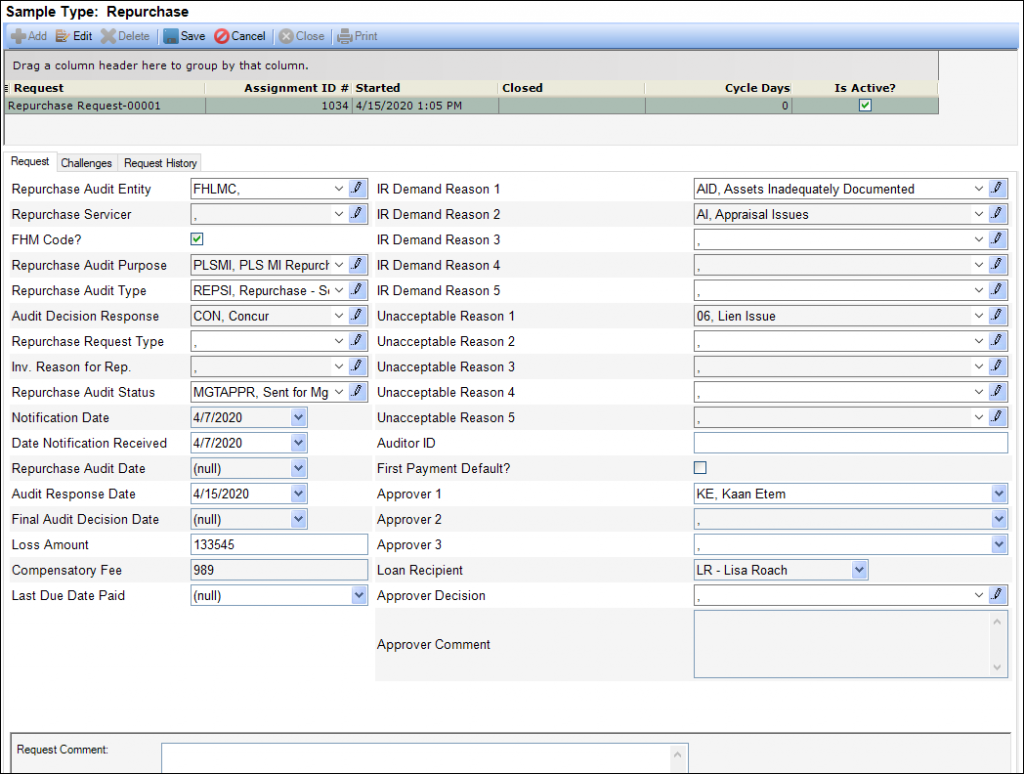

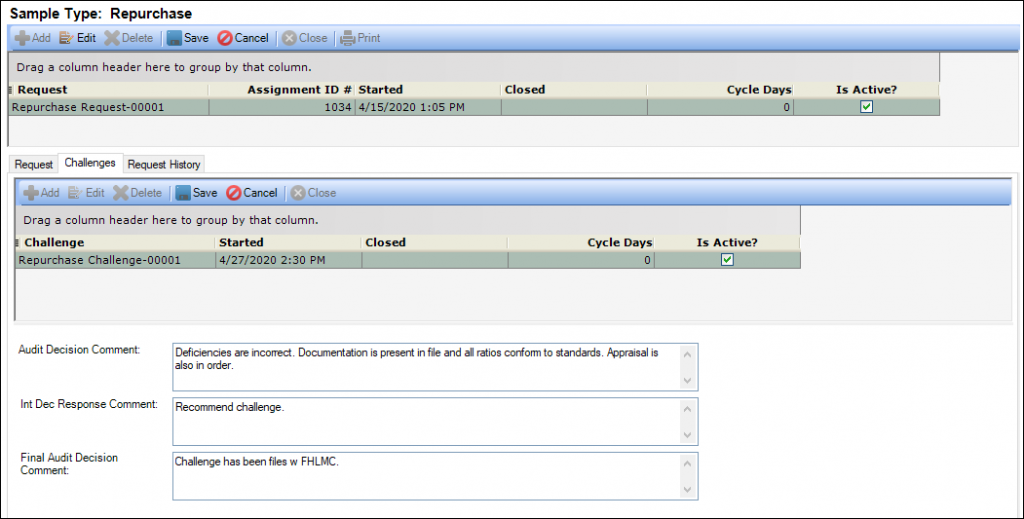

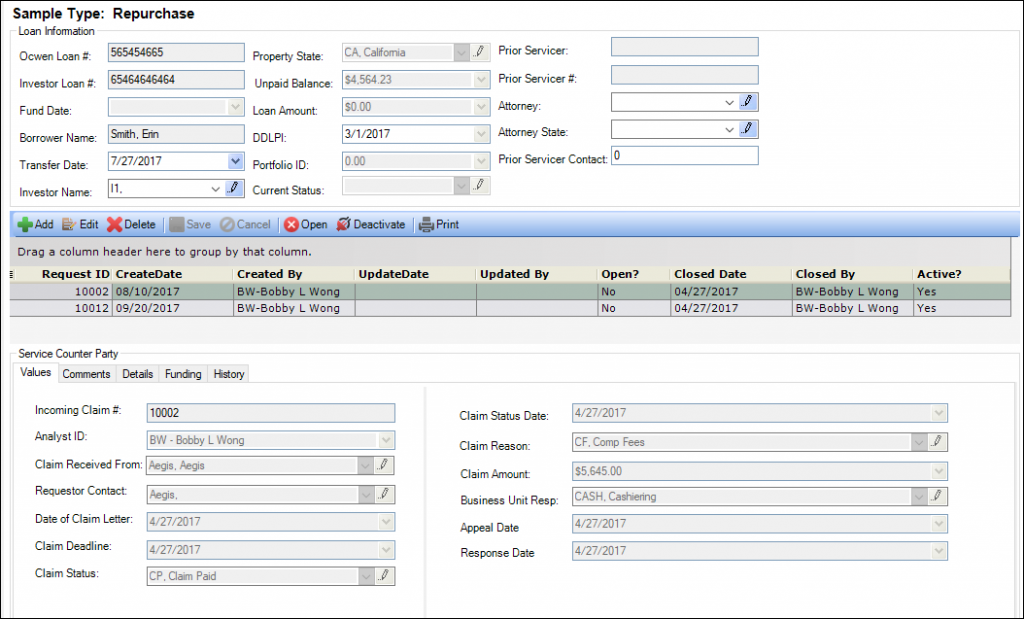

Custom Tool 1: Customized Repurchase, MI, & Claims Tracking Tool Pays for Itself Immediately

After the 2008 financial crisis, Cogent developed a tool for a client to efficiently track repurchase requests, challenges and repurchase resolutions.

Timely and accurate resolution of a single repurchase request paid cost of developing tool.

Tool embedded within Cogent system, facilitating user-training and consolidating reporting with primary application.

Tool deployed in several client systems after initial deployment.

Capabilities expanded subsequently to handle Mortgage Insurance claims and other servicing claims.

Tools still in use.

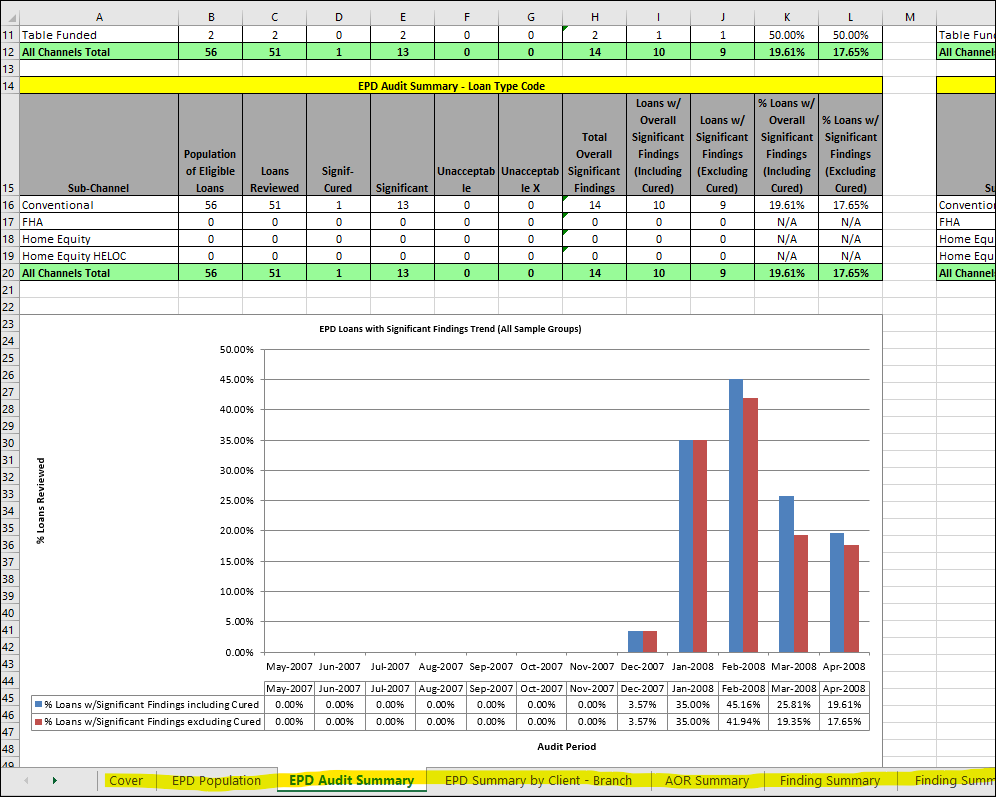

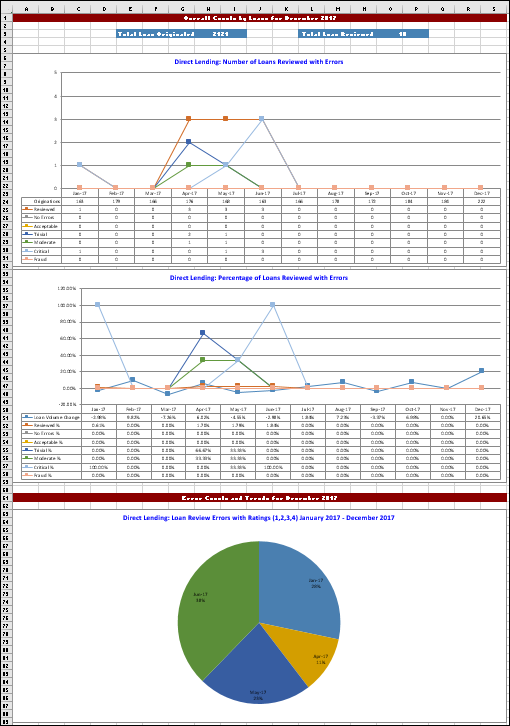

Custom Tool 2: Custom Reporting to Multi-Tab Excel Workbook Saves 25 Person-Hours Per Month

Developed dynamic, rules-based custom reports to push data into multi-tab Excel workbooks. Custom Tool enabled clients to save over 25 person-hours per month in manual report creation time, and also improved accuracy.

Final content and formatting driven by product lines, audit results, specified thresholds and more.

custom 3

Upon request, certain reports enhanced by charting, according to specifications.

custom3

Custom Tool 3: Custom Audit Workflow Reduces Work by 50%

To minimize auditor effort, reduced by 50%+ the number of actions required to conduct audits by enabling Audit Findings to be rendered by selecting a specified color of Preset Comment (i.e., a predefined comment that removes the need for auditor to spell out a comment).

No need to select a Finding or read the text of a Preset Comment – simply choose a color and the comment text is inserted with preset text, plus the appropriate finding is inserted automatically based on established rules.

Custom Tool 4: Customization Automates Lender Correspondence by Lender, Product & Underwriting Type

Client required multiple versions of different types of correspondence to be generated, based on lender, product type and type of underwriting (delegated vs non-delegated).

Cogent created a tool to customize text for each type of correspondence and to automatically generate, transmit and receive the right email for each situation.