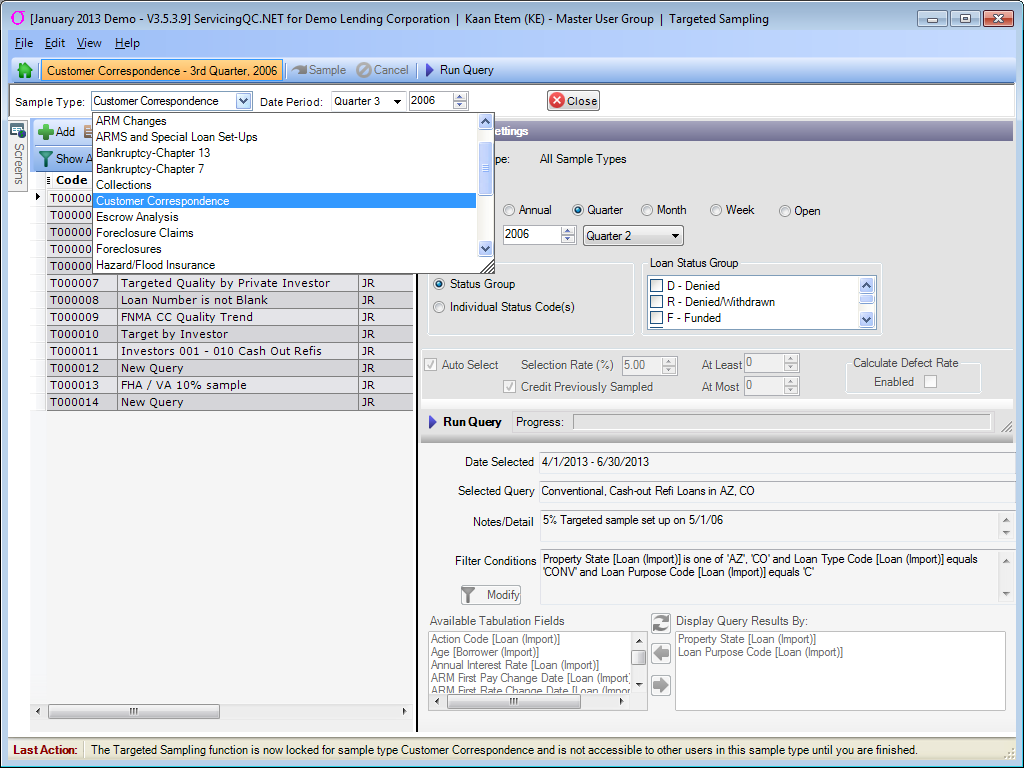

The ServicingQC System can be configured to audit any loan servicing, quality control or compliance process, for mortgage, consumer and/or auto loans. Administrator tools enable users to specify audit types and eligibility rules for each audit type. Targeted sampling within each audit type enables samples to be as broad or narrow as necessary, with automated tools for sample size estimation.

Audit Review Module Features

| • | Fully configurable audit modules allow different audit groups to create their own sampling, auditing and reporting workflows | ||

| • | Dynamic audit checklists respond to audit types and audit responses, streamlining audits and reducing work | ||

| • | Supervisor review and override options allow managers to monitor and correct auditor and vendor reviews | ||

| • | Automated reverification letter generation and tracking | ||

| • | Audit management tools enable automated audit assignment, audit sharing, feedback generation and reporting | ||

| • | User and audit activity tracked and stored in database | ||

| • | Customizable Audit Help screens allow managers to guide auditors | ||

| • | Referral and mirroring tools enable coordination across audit modules | ||

Mortgage servicing processes currently audited by Cogent users include:

| Adjustable Rate Mortgages (ARMs) ARMs and Special Loan Acquisitions Assumptions Balloon Loans Bankruptcy – AOs and NODs Bankruptcy – Closings Bankruptcy – Loan Acquisition and Setups Bankruptcy – MFRs Bankruptcy – POCs Bankruptcy – Research Cash Management Collections Correspondence Complaints Credit bureau reporting Customer Correspondence Delinquent loan management Escrow Analysis Escrow Account Management Escrow Impounds Fees FHA 235 Recertification FHA ARM Changes FHA Collections FHA Customer Correspondence FHA Escrow Analysis FHA Foreclosures FHA Hazard Insurance FHA Loan AcquisitionsFHA Loss Mitigation FHA MIP FHA Payoffs FHA Service Released |

FHA Taxes Forbearance Foreclosures Foreclosure Claims Hazard/ Flood Insurance HUD 235 loans HUD 203k HELOCs Insurance premiums Investor Reporting Loan Acquisitions Loan Assumptions Loan Boarding Loss Mitigation MERS Modifications MIP-PMI Newly-acquired loans Pay-Offs Periodic Statements PMI Property Seizures Reconveyances Reverse Mortgages (HECM) REO Repayment Plans SCRA Service Released Servicing Transfers Successors in Interest Taxes Tax impounds Workouts |

Consumer servicing processes currently audited by Cogent users include:

| Auto Credit Indirect Lending Home Equity Account Opening Unsecured Lending Branch Audit Insurance Premiums Customer Service Collections Disputes Repossession Bankruptcy Pay-off Processing |

Consumer Leasing Consumer Loans Lending Consumer Loans Servicing Deposit Accounts Electronic Funds Transfer (EFT) New Deposit Accounts Open-End Credit Accounts CRA Audits Marketing and Advertising Workouts Loan Counseling Credit Bureau Reporting Loss Mitigation |

ServicingQC Workflow

At the beginning of each audit cycle, the System’s SQL Server database is refreshed directly from your servicing system or data mart, providing the most recent servicing data for auditing. The System then enables separate, independent and asynchronous sampling and auditing of as many servicing functions as required. It also allows reporting and data export in multiple formats, enabling enterprises to combine data from mortgage quality control and compliance departments with data from other departments. Further, its native SQL Server tables are available for reporting via any number of reporting tools, including Business Objects, Crystal Reports, its own Report Writer module and others.