In a growing trend towards streamlining and standardization of quality control and compliance methodologies, HUD has introduced a Defect Taxonomy in its “FHA’s Single Family Housing Loan Quality Assessment Methodology“. This document lays out the methodology that the FHA plans to adopt to improve its own QA efforts.

In a growing trend towards streamlining and standardization of quality control and compliance methodologies, HUD has introduced a Defect Taxonomy in its “FHA’s Single Family Housing Loan Quality Assessment Methodology“. This document lays out the methodology that the FHA plans to adopt to improve its own QA efforts.

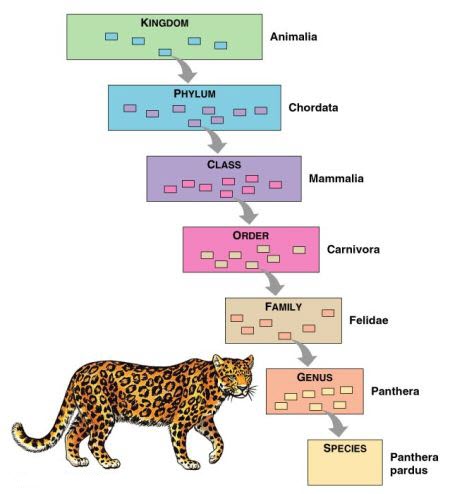

Knowing how FHA will be evaluating loans is helpful in designing your own QA program. Particularly useful is the definition of nine defect categories, numerous sources/causes for the defects, and four levels of defect severity. These can be roughly translated in ‘Cogentspeak’ to audit question categories, preset comments, and findings levels respectively.

For those configuring their Cogent FHA audit shells: your work has just become easier and more complex at the same time.