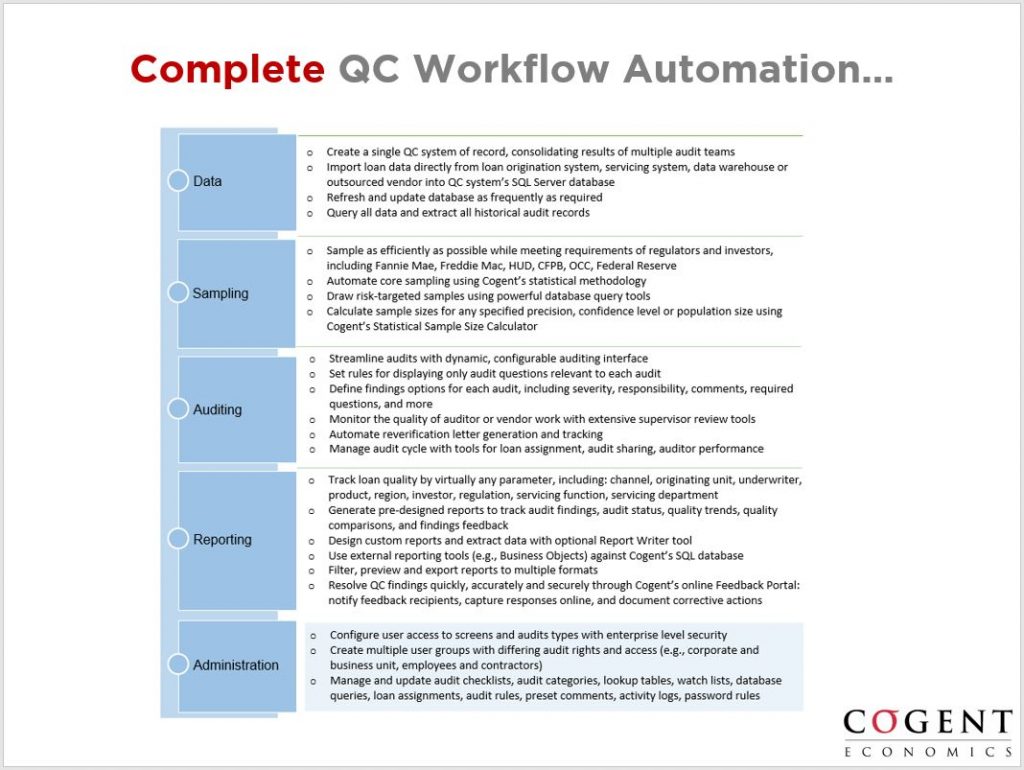

The mortgage QC sector has evolved to the point where most system providers automate the basic workflows in one way or another: import loan record data, sample loans, conduct audits, reverify documentation, send feedback to business units in the field, resolve findings, and generate reports.

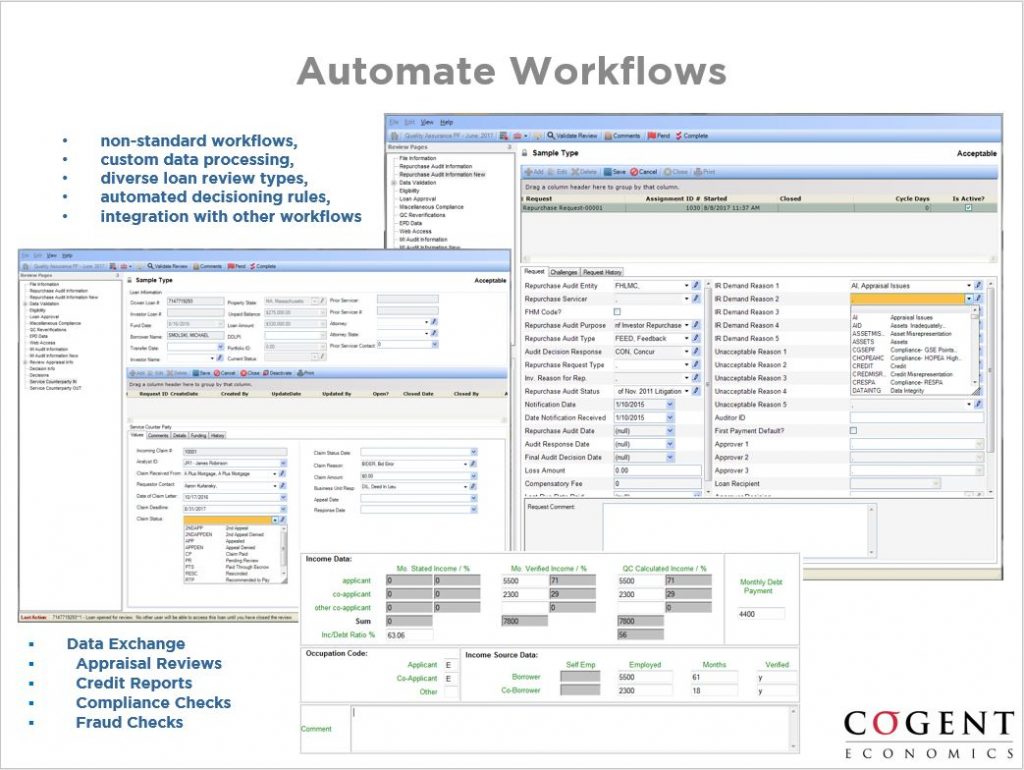

These aspects of the quality control process are well-honed and mature, so it’s comparatively easy to build systems and interfaces to manage them. The question is, what happens when you introduce different workflows, new workflows, or even new audit types?

Cogent’s system architecture, development staff and business model are aligned around helping lenders customize and automate their workflows and integrate them with other workflows in the organization.

If you’d like to hear about how we’ve helped our clients automate their processes, call us or email us at the coordinates at the top of the page. We’re happy to share.