The threat to Fannie and Freddie appears to be over.

Mel Watt, the Director of the Federal Housing Finance Agency, announced in a speech last week at the Brookings Institution that he plans to maintain the role played by Fannie Mae and Freddie Mac in the housing finance market. We think this is good news for the housing recovery, and also good news for those involved in risk management in the mortgage industry.

The housing industry recovery has been hampered by the uncertainty about the future role of Fannie and Freddie, and the pending legislative initiatives designed to unwind them. With that legislation now apparently stalled, and with Watt’s statements about supporting a continuing role for the agencies for the foreseeable future, the housing market should be lifted by the prospect of greater clarity and stability in the near term.

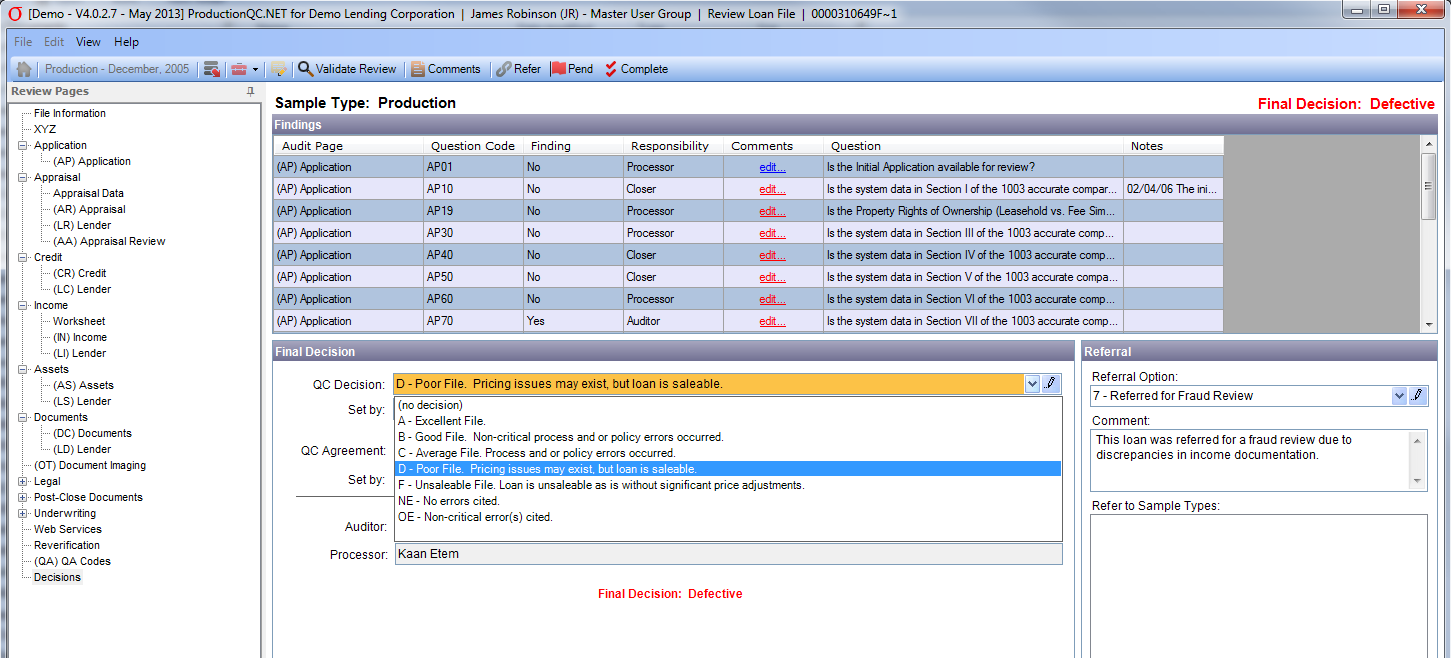

For risk managers in the mortgage industry, who have been tasked with implementing the myriad changes required under the new FHFA regulations imposed on lenders and servicers, the stability provided by this shift in policy toward Fannie and Freddie should be welcome. For decades, the agencies have been a primary source for risk management guidelines for the industry, and the threat of their demise – and the uncertainty about what would replace them – was a big added worry that can now be put on the shelf.

Link to May 13 Wall Street Journal blog post: https://blogs.wsj.com/economics/2014/05/13/six-takeaways-from-mel-watts-speech-on-housing/

Link to May 14 New York Times article: https://www.nytimes.com/2014/05/14/business/Melvin-Watt-shifts-course-on-fannie-mae-and-freddie-mac.html?hpw&rref=business