The title and central theme of this blog is “return on quality”, which we broadly define as the benefits to be gained from an intelligent and continuous approach to improving mortgage loan quality.

We said in an earlier post that we would try to formulate “return on quality” and as a step in that direction, we offer a Cogent white paper called “Quality Performance Benchmarking” that was originally developed for an audience of mortgage quality control professionals.

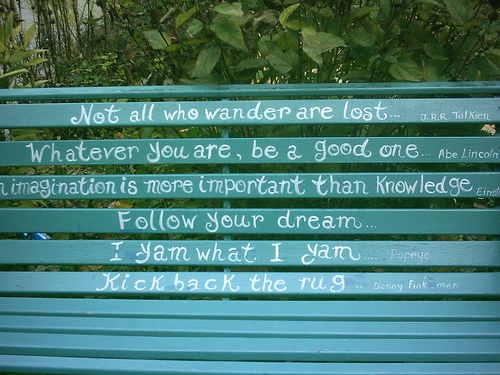

Image by jacob earl

In this paper, we talk about the prevalence in the mortgage industry of a production maximization mentality, in which metrics and compensation are centered on volume; the potential hazards of this mentality; guidelines for estimating the costs of poor quality, (the inverse of the return on quality); how to reward good quality; and how to craft appropriate performance metrics, or benchmarks. The second part of the paper talks in depth about one of the most powerful tools for benchmarking performance, control charts.

This white paper was written in 2002. Nothing has changed in the methodology. But in the last couple of years, the eyes of most of us in the industry have been opened to the dangers of focusing exclusively on volume, volume, volume. We welcome your comments.