Fannie Mae announced new quality control guidelines on July 30, 2013 that include a requirement for lenders to track defect rates:

https://www.fanniemae.com/content/announcement/sel1305.pdf

https://www.fanniemae.com/content/tool/qc-defect-rate-tutorial.pdf

Do you know your defect rates? If not, you will have to implement a process to track them in order to sell to Fannie Mae after January 1, 2014.

Surprisingly, Fannie’s new guidelines say that lenders should report both a “gross” defect rate and a “net” defect rate, (meaning “net” of defective loans that can be fixed.) Really? Loans that can be fixed after closing still cost the lender substantially more than loans done right the first time. And what about all the similarly defective loans in the population that weren’t sampled? Consider that an error that can be fixed 30-60 days after close may not be so fixable if the loan goes delinquent 10 months after close and is now a repurchase candidate. This means you can’t reliably extrapolate from a “net” sample defect rate to “net” population defect rate (interval).

Fannie’s new guidelines also say that lenders should track defect rates by severity, such as “moderate defects” vs. “significant defects”. This confuses ‘defects’, which are loan-level ratings, with ‘errors’, which are audit question-level ratings. This is more than just semantics. The final rating on a loan review should be a binary one: acceptable or defective. This is a requirement if statistical sampling is to be used.

Cogent has long asserted that the focus in QC reporting should be on the gross defect rate; this is the rate used to calculate sample sizes in our applications. Ultimately, the objective of quality control is not to fix defective loans in your samples, but to understand where the defects are coming from and fix the process.

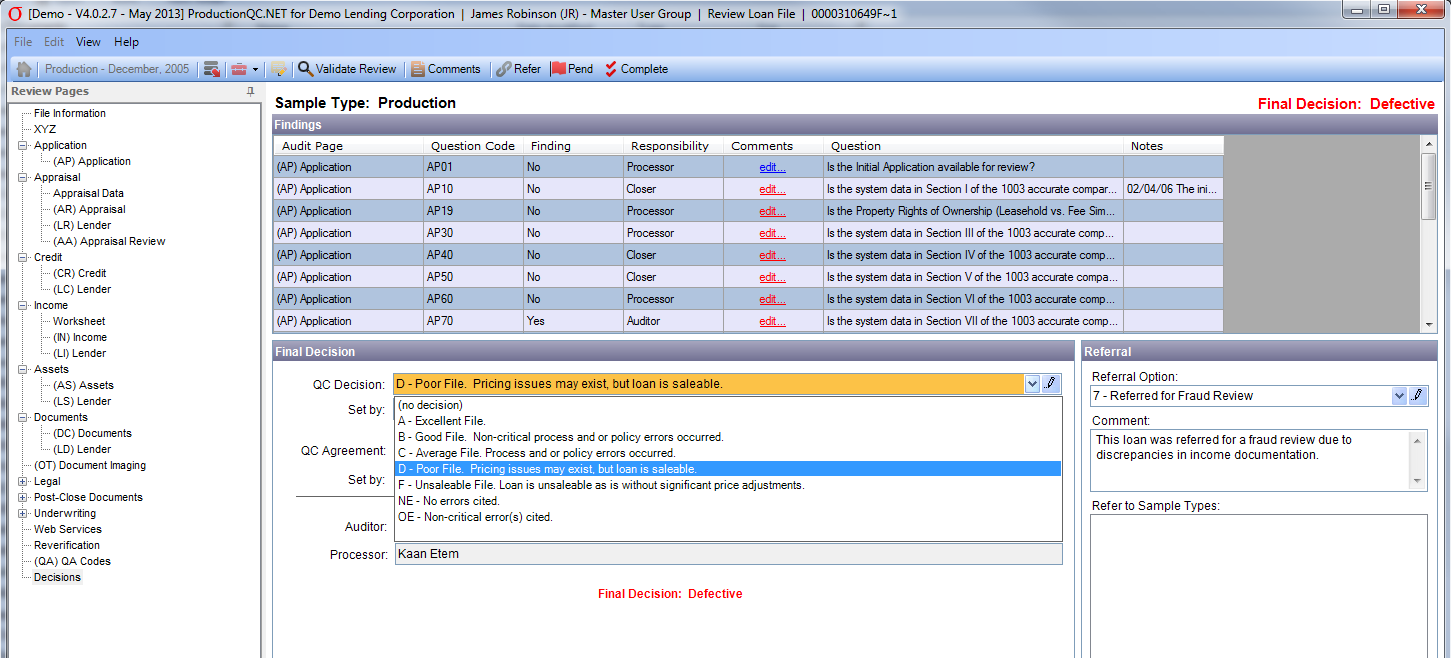

Cogent clients are able to track gross defect rates with the standard functionality built into both the ProductionQC and ServicingQC applications. In Cogent’s applications, at the conclusion of each loan review, the QC auditor must assign an overall QC Decision. The descriptions of the available QC Decisions are controlled by the System Administrator, but each will result in a Final Decision of either Acceptable or Defective, as shown in the screen shot.

Assigning this Final Decision enables users to generate the Cogent Management Reports, which show gross defect rate trends and comparisons, and also to calculate and select properly-sized statistical samples based on the recent 3-period average defect rate for each sample type.