This is the fifth in a multi-part series discussing statistical techniques to make your loan quality control more efficient and more effective.

# 5 – Take Credit for Previously Sampled Loans

PRINCIPLE

Leverage your sampling by allowing qualifying loans to count towards multiple samples.

ILLUSTRATION

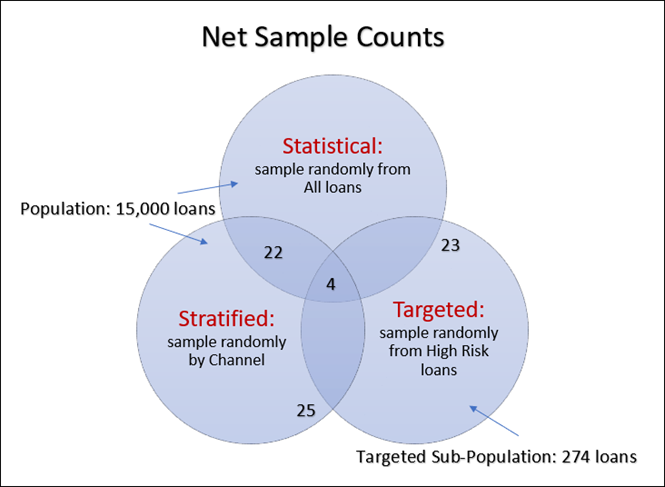

Lender A uses a layered sampling strategy, whereby a random statistical sample is drawn first, followed by a stratified sample (by wholesale and by retail channels), followed by a targeted sample focused on a sub-population of “high-risk” loans (e.g., low credit score plus high LTV).

Originating 15,000 loans per year, the lender calculates that the following monthly gross sample counts would be required to meet the 2% precision and 95% confidence levels required for each sample (except the Targeted High Risk sample, which simply draws a flat 10% sample).

| Gross Sample Counts | |

| Statistical | 26 |

| Stratified Retail | 25 |

| Stratified Wholesale | 26 |

| Targeted High Risk | 27 |

| TOTAL | 104 |

The lender could simply draw the four samples totaling 104 loans, as above, and meet requirements. However, they see a more efficient approach. 30 of these 104 loans qualify for more than one of the above samples. These 30 “overlapping” loans can do double or triple duty. Assuming the audit scope and time period of the samples are the same, (e.g., post-closing audits for loans originated in March 2022), such loans can count towards the results of multiple samples, thereby reducing the total number of audits required.

| Gross Sample Counts | Net Sample Counts (Credit Previously Sampled) | |

| Statistical | 26 | 26 |

| Stratified Retail | 25 | 3 |

| Stratified Wholesale | 26 | 22 |

| Targeted High Risk | 27 | 23 |

| Total | 104 | 74 |

| TOTAL SAVINGS | 30 |

EXAMPLE

If we allow this credit for previously sampled loans, then in the current example we find that of the 26 loans in the Statistical Sample, 22 count towards the Stratified Retail sample and 4 count towards the Stratified Wholesale sample. This means we only have to sample a net 3 more Stratified Retail loans (not 25!) and a net 22 more Stratified Wholesale loans (not 26!).

Similarly, 4 loans from the Statistical sample qualify for the Stratified sample and for the Targeted sample. Those 4 loans can do triple duty, counting towards all three types of samples.

The net result of leveraging their sampling in this way allows the lender, in this case, to save 30 audits per month. At $200 per audit, this amounts to $72,000 per year in annual savings.

About Cogent QC Systems

We embed and automate statistical principles throughout our award-winning QC and risk management applications, making you more efficient and more effective at each step of your workflow.