This is the third in a multi-part series showing how statistical techniques can make your loan quality control more efficient and more effective.

#3 – Decide How Much Precision You Need

PRINCIPLE

Precision level has a big impact on the number of loan reviews required and not all samples require the “industry standard” of 2% precision.

ILLUSTRATION

In the previous post, we saw that defect rate can have a material impact on the number of loans that must be sampled and reviewed, all else being equal. But precision level has an even greater impact. And while the agencies have confidence level and precision standards for random statistical samples (e.g., 95% confidence at 2% precision), you may have more leeway with respect to your discretionary or targeted samples. With constrained resources (e.g., available auditors), reducing precision may be an effective way to reduce workload while maintaining statistical integrity.

EXAMPLE

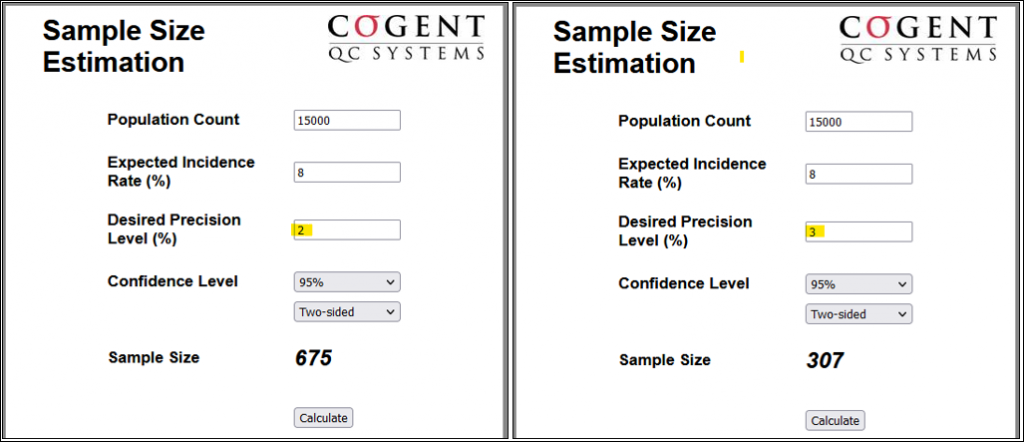

In our previous post, we saw that a lender originating 15,000 loans per year could reduce their random sample by 316 loans by lowering their defect rate from 8% to 4%. As a point of comparison, the same lender with an 8% defect rate could reduce their sample size by 368 loans (675 – 307) simply by lowering the precision level requirement from 2% to 3%.

Note 1: As noted, random statistical samples usually must meet agency confidence and precision requirements. However, for many lenders, discretionary and targeted samples can be cumulatively larger than the random samples. If a precision level of 3% or even 4% is used for those, there is potential for substantial savings. Even with lower precision levels, the relative performance of audited units is usually apparent and further sampling/review of adverse findings can provide insight into quality problems.

About Cogent QC Systems

We embed and automate statistical principles throughout our award-winning QC and risk management applications, making you more efficient and more effective at each step of your workflow.