This is the second in a multi-part series showing how statistical techniques can make your loan quality control more efficient and more effective.

#2 – Improve Loan Quality and Reduce Sample Size

PRINCIPLE

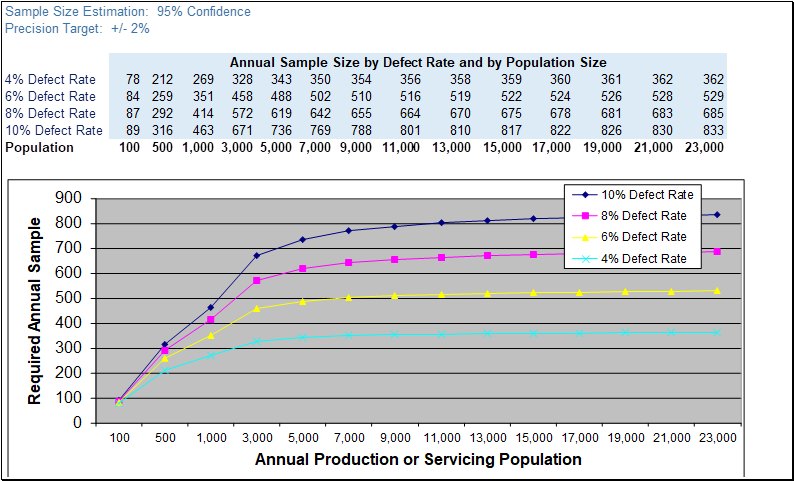

The lower your defect rate (or “incidence rate”), the smaller the sample size required (all else being equal).

ILLUSTRATION

In the previous post, we saw that when using a statistically calculated sample size, larger population sizes have almost no impact on sample size requirements (beyond a minimum threshold). So what does make a difference? The chart shows the estimated sample sizes by population size by defect rate. Here we see that the higher the defect rate, the more loans must be sampled and audited.

EXAMPLE

A lender originating 15,000 loans per year could reduce their random sample by 316 loans by lowering their defect rate from 8% to 4% (675 – 359 = 316). At $200 per audit, these savings have a value of $63,200 per year. This reduced sample size is a cherry on top of the gains that come with improved loan quality, which are usually significant.

Note 1: While most QC shops show net (post-cure) defect rates in their reports, for purposes of sampling it is recommended that gross defect rate is used. Remember that while some sampled loans may have been cured, the equivalent proportion of loans in the population have not.

Note 2: Many QC departments report only on the number of findings or errors encountered, without rendering a binary decision at the loan level (acceptable vs. defective). Often a plug number (say 5%) is used every sample period. With a binary decision at the loan level that reflects recent experience (whether you report it or not), you have an opportunity to sample fewer loans as defect rates are reduced.

About Cogent QC Systems

We embed and automate statistical principles throughout our award-winning QC and risk management applications, making you more efficient and more effective at each step of your workflow.