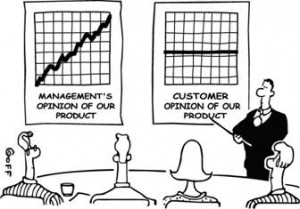

“The availability of meaningful and actual information is a true weakness in QC today.” So says Jeremy Burcham, AVP of Loan Review Solutions at Interthinx in a recent video in National Mortgage News’ Ask the Experts series. We agree with that. We also agree when he states that many QC operations – including outsourced QC firms – are not focused on obtaining performance data that will help them improve their processes. Instead, they are often focused on individual issues like fixing a particular loan, or internal issues like what is politically correct within their organizations, or a meaningless metric (e.g., total number of errors found, regardless of context), or even just completing their assigned reviews by the deadline.

Given that the purpose of quality control is to improve processes, there are few activities more important than thinking through the appropriate metrics to use to track progress. If you don’t know where you’re going, as the adage goes, how will you know when you get there? Cogent has some ideas about how to approach this and we invite you to browse the white papers on our website for more information. And there are others with deep expertise in this area. For instance, Avinash Kaushik, one of the most respected authorities on Web Analytics, has these guidelines on the attributes of great metrics.

Given that the purpose of quality control is to improve processes, there are few activities more important than thinking through the appropriate metrics to use to track progress. If you don’t know where you’re going, as the adage goes, how will you know when you get there? Cogent has some ideas about how to approach this and we invite you to browse the white papers on our website for more information. And there are others with deep expertise in this area. For instance, Avinash Kaushik, one of the most respected authorities on Web Analytics, has these guidelines on the attributes of great metrics.

For now, though, a tip of the hat to Interthinx for helping raise awareness of the need for good, meaningful and actionable data.