This is the first in a multi-part series showing how statistical techniques can make your loan quality control more efficient and more effective.

#1 – Use Statistically Calculated Samples vs. Straight Percentage Samples

PRINCIPLE

It is more efficient to use a statistically calculated sample size than a straight percentage sample, once population size exceeds a required threshold.

ILLUSTRATION

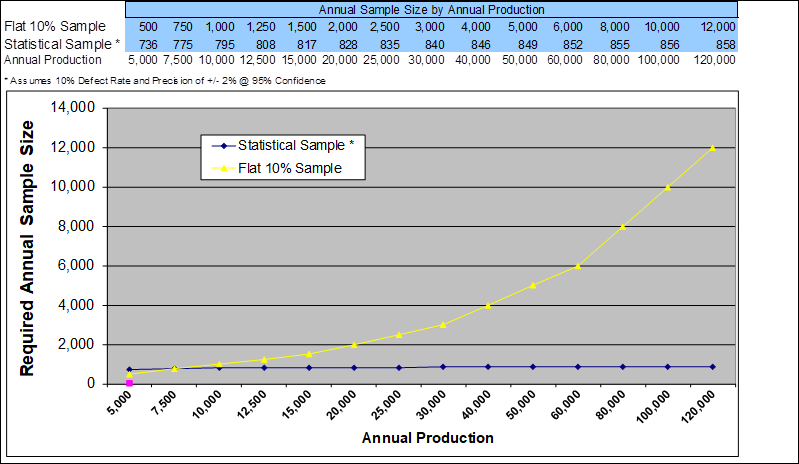

Chart 1 below shows the different sample sizes required when using a statistically calculated sample size (black line) vs. a flat percentage (yellow line), at various annual production levels. Two things stand out:

1. Once the population of loans from which you are sampling reaches a certain threshold, it is more efficient to use a statistically calculated sample rather than a straight percentage sample.

2. As population size increases, the statistically calculated sample size remains about level, while the flat percentage continues to climb steadily. So efficiency increases with population size.

EXAMPLE

A lender originating 20,000 loans per year can randomly sample 1,172 fewer loans per year by using a statistically calculated sample (2,000 – 828 = 1172). The value of these savings is about $234,400 per year, assuming an average cost of $200 per audit.

The minimum population threshold depends on different factors, including your investors’ minimum requirements. For example, as of this writing FHA requires a population size of 3,500 before statistical sampling is permitted.

Once past the population threshold, sample size is driven primarily by your loan defect rate and your statistical precision and confidence requirements. We will address each of these elements in upcoming articles. Next Up:

#2 – Improve Loan Quality and Reduce Sample Size

Meanwhile, you can experiment with Cogent’s free Statistical Sample Size Calculator to see what has the biggest impact on sample size.

Ultimately, even if you plan on auditing the same number of loans, it is more effective to minimize your random sample so that you can focus on discretionary and targeted risk areas, resulting in broader, deeper and more precise insight into loan quality.

About Cogent QC Systems

We embed and automate statistical principles throughout our award-winning QC and risk management applications, making you more efficient and more effective at each step of your workflow.