Lenders and servicers with better quality control achieve not only cost reductions, better market pricing and regulatory advantages, but also better customer response and retention.

A Single Platform for All Audits Across the Enterprise

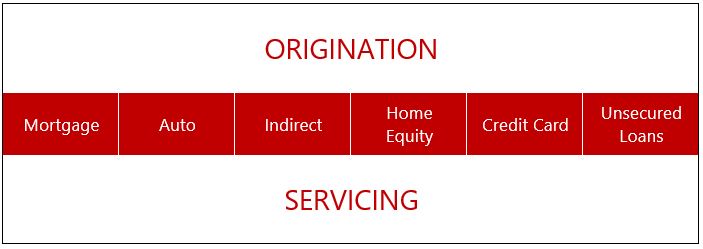

Cogent QC Systems help you correct root causes of loan defects across the entire breadth of your origination and servicing operations.

From pre-funding origination QC through pay-off servicing QC and beyond, Cogent optimizes your workflow, providing maximum QC insight at optimal cost.

And you can audit any type of loan, from mortgages to auto loans, from credit cards to unsecured loans.

Challenges and Solutions

What are the challenges that lenders face in their QC operations? And how does Cogent solve those challenges?

Bring QC In-House

Boost QC Productivity

Manage Expanding Audit Scope and Volume

Improve Reporting & Analytics

Optimize QC Across the Enterprise

Challenges and Solutions

Client Success Stories >>

Bring QC In-House

CHALLENGE: Outsourcing expenses are high, quality of reviews is inconsistent, process is not flexible, and you still need to review 3rd party results in-house

SOLUTION: Bring QC in-house to lower cost, increase flexibility, improve turn times

The only way to gain control over your QC process, to ensure its efficacy, and to keep costs contained is to do it in-house. Small lenders may have no choice but to outsource QC reviews until they scale up their operations. Conversely, some larger lenders outsource certain reviews to accommodate volume spikes. But the best practice is to do it in-house.

Our In-House QC vs. Outsourced QC analysis provides an overview of the issues to consider in making this decision. In addition, a simple cost/benefit analysis illustrates, for a hypothetical lender, the economic benefits to be gained simply by following Cogent’s proprietary statistical sampling methodology. The ROI and payback period is compelling. If this methodology is also integrated into a system that embeds best practices in quality control and compliance auditing, then the gains are amplified.

Boost QC Productivity

CHALLENGE: Inadequate tools and inconsistent processes make QC operations inefficient and haphazard

SOLUTION: Establish a single QC software platform and standardize processes

Traditionally, quality control and compliance audits have been viewed as “necessary costs”, so organizations have tended to minimize investment in technology and resources to streamline processes. “Getting by with Excel spreadsheets” has been the default approach. This has resulted in huge inefficiencies, redundant work and high full-time-employee (FTE) counts.

In contrast, Cogent QC Systems leverage decades of experience in the industry to create integrated sampling and reporting capabilities to produce a total workflow solution that automates critical tasks and enhances the overall productivity of quality control departments. Cogent QC Systems not only minimize your sample sizes, they also make your entire QC process more efficient. Most new clients see productivity improvements of 50% or more in the key areas of sampling, auditing and reporting. This translates into lower staffing costs and better coverage of risks.

Manage Expanding Audit Scope and Volume

CHALLENGE: As Origination and Servicing volumes increase, so do the costs of quality control audits

SOLUTION: Reduce random samples and leverage Cogent’s statistical methodology to intelligently target samples

The cost to conduct a standard post-closing audit can vary from $100 to $200 or more per audit. As volumes spike, costs spike — unless you take a different approach. When large lenders and servicers told Cogent they wanted to reduce the burden of meeting Fannie Mae, Freddie Mac, and HUD quality control requirements, we pioneered the substitution of statistical sampling in place of the straight 10% sample then used for mortgage quality control. Our innovative methodology allowed lenders to reduce their random sampling to 2% or less of their total originations, resulting in immediate and significant cost savings for Cogent clients.

Here is an actual example of client savings:

10% Flat Sample | Cogent Statistical Sample | |

| Loan Population | 19,000 | 19,000 |

| Sample Size | 1,900 loans (10%) | 318 loans (1.7%) |

| Cost Per Audit | $125 | $125 |

| Total Audit Cost | $237,500 | $39,750 |

By reducing their random sample sizes, lenders and servicers are able to emphasize targeted reviews of the riskiest loans. This approach is fundamental to Cogent’s methodology and has greatly improved our clients’ efficiency, helping them achieve significant savings and better risk management.

Improve Reporting & Analytics

CHALLENGE: Reporting of QC results is inadequate, not actionable, error-prone and/or time-consuming

SOLUTION: Use Cogent’s innovative management reports and custom Report Writer to isolate issues and drill down to root causes

Cogent’s sophisticated, actionable reports provide statistically valid quality trends and comparisons. These clear, concise reports allow quality control departments to quickly analyze their business from different perspectives, continuously improve their processes, and contribute to the profitability of their enterprise.

Optimize QC Across the Enterprise

CHALLENGE: Inadequate tools and inconsistent processes make QC operations inefficient and haphazard

SOLUTION: Establish a single QC software platform and standardize processes across the enterprise

In many organizations, loan quality control and compliance operations are very fragmented. Multiple groups – including pre-funding QC, post-closing QC, compliance, fraud, repurchase, servicing, and others – have overlapping responsibilities and use different systems. The differing data formats and reporting approaches make it difficult for IT to support them and for senior management to make informed decisions.

Cogent QC Systems are designed to be deployed across the enterprise (regionally, nationally, globally) so team members in different locations can work on the same system simultaneously. They are modular, which means organizations can deploy only the modules they require and add on new functionality as needed. And they use a common, standardized technology that enables data sharing across Cogent applications and with other systems in the enterprise.

Cogent QC applications are a major step forward in usability, power and flexibility.